The combined revenues of the top four strategy consulting firms—McKinsey, BCG, Bain, and AT Kearney—crossed the $1-billion milestone in India in FY24, according to ministry of corporate affairs filings. This is a first for the country’s high-value consulting industry, coming nearly 33 years after McKinsey set up its India office under the late Tino Puri in 1992 to kickstart modern management consulting in India.

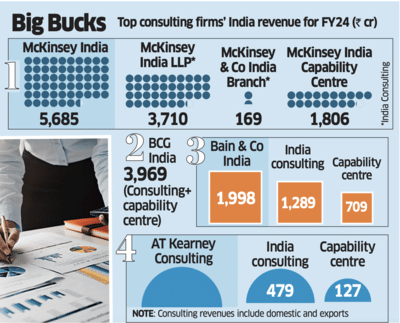

Latest filings from Tofler show combined consulting revenue for McKinsey, Bain and AT Kearney in FY24 at ₹5,647 crore, with BCG India’s consulting-only income estimated at over ₹3,600 crore, taking the total past ₹9,247 crore ($1.1 billion) and underscoring the sector’s growing maturity alongside the country’s surge. BCG doesn’t report separate consulting and capability centre numbers.

Rajat Dhawan, India MD and senior partner at McKinsey & Co, said McKinsey India has doubled in size since the pandemic and is expanding its footprint and impact through long-term partnerships that support clients in India and overseas.

“India presents an opportunity no one wants to miss, and companies need help navigating this robust growth,” said Rahul Jain, chief executive, BCG India.

“India presents an opportunity no one wants to miss, and companies need help navigating this robust growth,” said Rahul Jain, chief executive, BCG India.

Demand Driven by New Ventures, Evolving Tech

Growing at an average 15-16%, with one firm touching 18%, the top four are on a strong trajectory in India, outpacing the single-digit or stagnant expansion by their US and European arms.

With FY25 numbers still to be reported and much of FY26’s business already booked, ET estimates the firms’ combined India revenues will cross ₹12,500 crore in FY26 ($1.5 billion), and by FY30, that figure is projected to reach between ₹21,389 crore and ₹22,529 crore ($2.58–2.71 billion).

In confidential assessments to their global headquarters, the consultants have said that the more likely outcome is a clean break past $3 billion, a remarkable acceleration, with the next lap of $2 billion expected in less than a decade after 33 years to notch the first billion.

Market stabilisation

Consulting firms say that after the post-Covid surge, the market largely stabilised in FY24 on demand driven not just by growth in core businesses but also by new ventures and technology transformation projects at conglomerates; scaling and transformation initiatives at mid-sized firms; profitability mandates from PE-backed companies; large-scale programmes commissioned by public sector undertakings and central and state governments. Lately, there is a surge in work around artificial intelligence and global capability centres (GCCs).

“In these uncertain times, many firms are adjusting their operating models, balancing resilience and efficiency, evaluating several Make in India-triggered opportunities, and continuing to invest in digital and technology while preparing for an AI-driven future,” said BCG’s Jain.

Individually, McKinsey & Co’s India consulting operations reported combined revenues of 3,879 crore in FY24, spread across McKinsey India LLP and McKinsey India Branch Office.

Within McKinsey India LLP, which accounts for about 95% of the firm’s business in the country, exports contributed ₹1,300.19 crore. BCG reported ₹1,364.48 crore in foreign exchange earnings from both its India consulting arm and capability centre in FY24.

However, getting the exact size of the domestic consulting revenue of these firms is trickier. A part of what shows up in filings as “exports” includes services delivered to Indian clients outside the country, and even projects executed from special economic zones within India that are technically booked as exports.

Experts also caution against a straight comparison across firms. Domestic revenues, export earnings, transfer pricing, and even expenses are treated differently depending on each firm’s business mix and entity structure. However, in consulting, a proxy for growth is partner strength, since consulting revenues tend to track closely with the size of a firm’s partner bench.

By that measure, BCG now leads in India with about 112 partners (another eight to 10 salaried), followed by McKinsey with 90. Yet, McKinsey is widely seen as setting the industry benchmark on productivity and pricing. Bain, with around 60 partners, and AT Kearney, with 31, operate with a smaller partner group.

In terms of profitability, BCG posted ₹385 crore in profit before depreciation and provision for tax. McKinsey, by contrast, reported a net profit before tax of ₹75 crore, a smaller figure but one that insiders attribute largely to its higher payouts to equity partners.

In the last five years, the nature of client engagements has changed at a faster clip, say consultants.

“Consulting contracts are evolving—moving towards longer, outcome-based engagements. The old advisory-only model has given way to deeper partnerships,” said Siddharth Jain, chief executive, AT Kearney. “What used to be two- to three-month assignments now typically run 10–12 months, with execution and measurable outcomes becoming the default. At the same time, we’re seeing robust growth in client demand, as organisations increasingly seek partners who can drive tangible impact rather than just provide recommendations.”

Between 60-80% of the work at top management consulting firms comes from repeat clients.

Though the overall consulting pie is growing, competition for top mandates is intensifying, with Big Four consulting arms, mid-sized challengers such as Alvarez & Marsal and Oliver Wyman (now led by former BCG senior partner Sumit Saraogi), and IT giants like Accenture generating between $30–40 million in high-value management consulting work.

Even smaller global consulting firms have aggressive plans.

“Our value proposition is closer to MBB firms (McKinsey, BCG, Bain) than Big Four and other tech consulting firms. We have very ambitious expansion plans for our consulting business in India,” said Himanshu Bajaj, chief executive, Alvarez & Marsal India.

Like in India, the big battle in global consulting is between McKinsey and BCG.

$16 bn revenue in 2023

According to the last officially reported figures, McKinsey generated $16 billion in revenue in 2023, compared with BCG’s $12.3 billion. In 2024, BCG’s revenue rose to $13.5 billion, while McKinsey officially has not reported its numbers. McKinsey has been the market leader and gold standard since its founding in 1926, but BCG has been playing catch-up in recent years. Experts attribute BCG’s rise to its more adaptable client model, quicker pivots into high-growth areas such as ESG and technology and strong performance in fast-expanding markets like India, Japan, and Brazil.

In India, another major focus for these firms is their capability centres. These are rapidly growing over the past five years as global cost pressures increase, driving greater reliance on offshore talent and reshaping the traditional consulting delivery model. The Indian arms of McKinsey, Bain, and AT Kearney generate a combined Rs 2,642 crore in revenue from their capability centres and are scaling up aggressively to handle both back-end delivery and increasingly complex client mandates.

For consultants globally and in India, artificial intelligence has been the new buzzword over the past couple of years. “AI today is what digital was five years ago,” said Jain of AT Kearney.

BCG’s Rahul Jain said consulting has evolved from being knowledge-based to focusing on execution and results. “Now it’s about capability, helping clients not just design strategies but build and strengthen businesses. AI will increasingly be an integral part of this journey, embedded across future client assignments.”

Latest filings from Tofler show combined consulting revenue for McKinsey, Bain and AT Kearney in FY24 at ₹5,647 crore, with BCG India’s consulting-only income estimated at over ₹3,600 crore, taking the total past ₹9,247 crore ($1.1 billion) and underscoring the sector’s growing maturity alongside the country’s surge. BCG doesn’t report separate consulting and capability centre numbers.

Rajat Dhawan, India MD and senior partner at McKinsey & Co, said McKinsey India has doubled in size since the pandemic and is expanding its footprint and impact through long-term partnerships that support clients in India and overseas.

Demand Driven by New Ventures, Evolving Tech

Growing at an average 15-16%, with one firm touching 18%, the top four are on a strong trajectory in India, outpacing the single-digit or stagnant expansion by their US and European arms.

With FY25 numbers still to be reported and much of FY26’s business already booked, ET estimates the firms’ combined India revenues will cross ₹12,500 crore in FY26 ($1.5 billion), and by FY30, that figure is projected to reach between ₹21,389 crore and ₹22,529 crore ($2.58–2.71 billion).

In confidential assessments to their global headquarters, the consultants have said that the more likely outcome is a clean break past $3 billion, a remarkable acceleration, with the next lap of $2 billion expected in less than a decade after 33 years to notch the first billion.

Market stabilisation

Consulting firms say that after the post-Covid surge, the market largely stabilised in FY24 on demand driven not just by growth in core businesses but also by new ventures and technology transformation projects at conglomerates; scaling and transformation initiatives at mid-sized firms; profitability mandates from PE-backed companies; large-scale programmes commissioned by public sector undertakings and central and state governments. Lately, there is a surge in work around artificial intelligence and global capability centres (GCCs).

“In these uncertain times, many firms are adjusting their operating models, balancing resilience and efficiency, evaluating several Make in India-triggered opportunities, and continuing to invest in digital and technology while preparing for an AI-driven future,” said BCG’s Jain.

Individually, McKinsey & Co’s India consulting operations reported combined revenues of 3,879 crore in FY24, spread across McKinsey India LLP and McKinsey India Branch Office.

Within McKinsey India LLP, which accounts for about 95% of the firm’s business in the country, exports contributed ₹1,300.19 crore. BCG reported ₹1,364.48 crore in foreign exchange earnings from both its India consulting arm and capability centre in FY24.

However, getting the exact size of the domestic consulting revenue of these firms is trickier. A part of what shows up in filings as “exports” includes services delivered to Indian clients outside the country, and even projects executed from special economic zones within India that are technically booked as exports.

Experts also caution against a straight comparison across firms. Domestic revenues, export earnings, transfer pricing, and even expenses are treated differently depending on each firm’s business mix and entity structure. However, in consulting, a proxy for growth is partner strength, since consulting revenues tend to track closely with the size of a firm’s partner bench.

By that measure, BCG now leads in India with about 112 partners (another eight to 10 salaried), followed by McKinsey with 90. Yet, McKinsey is widely seen as setting the industry benchmark on productivity and pricing. Bain, with around 60 partners, and AT Kearney, with 31, operate with a smaller partner group.

In terms of profitability, BCG posted ₹385 crore in profit before depreciation and provision for tax. McKinsey, by contrast, reported a net profit before tax of ₹75 crore, a smaller figure but one that insiders attribute largely to its higher payouts to equity partners.

In the last five years, the nature of client engagements has changed at a faster clip, say consultants.

“Consulting contracts are evolving—moving towards longer, outcome-based engagements. The old advisory-only model has given way to deeper partnerships,” said Siddharth Jain, chief executive, AT Kearney. “What used to be two- to three-month assignments now typically run 10–12 months, with execution and measurable outcomes becoming the default. At the same time, we’re seeing robust growth in client demand, as organisations increasingly seek partners who can drive tangible impact rather than just provide recommendations.”

Between 60-80% of the work at top management consulting firms comes from repeat clients.

Though the overall consulting pie is growing, competition for top mandates is intensifying, with Big Four consulting arms, mid-sized challengers such as Alvarez & Marsal and Oliver Wyman (now led by former BCG senior partner Sumit Saraogi), and IT giants like Accenture generating between $30–40 million in high-value management consulting work.

Even smaller global consulting firms have aggressive plans.

“Our value proposition is closer to MBB firms (McKinsey, BCG, Bain) than Big Four and other tech consulting firms. We have very ambitious expansion plans for our consulting business in India,” said Himanshu Bajaj, chief executive, Alvarez & Marsal India.

Like in India, the big battle in global consulting is between McKinsey and BCG.

$16 bn revenue in 2023

According to the last officially reported figures, McKinsey generated $16 billion in revenue in 2023, compared with BCG’s $12.3 billion. In 2024, BCG’s revenue rose to $13.5 billion, while McKinsey officially has not reported its numbers. McKinsey has been the market leader and gold standard since its founding in 1926, but BCG has been playing catch-up in recent years. Experts attribute BCG’s rise to its more adaptable client model, quicker pivots into high-growth areas such as ESG and technology and strong performance in fast-expanding markets like India, Japan, and Brazil.

In India, another major focus for these firms is their capability centres. These are rapidly growing over the past five years as global cost pressures increase, driving greater reliance on offshore talent and reshaping the traditional consulting delivery model. The Indian arms of McKinsey, Bain, and AT Kearney generate a combined Rs 2,642 crore in revenue from their capability centres and are scaling up aggressively to handle both back-end delivery and increasingly complex client mandates.

For consultants globally and in India, artificial intelligence has been the new buzzword over the past couple of years. “AI today is what digital was five years ago,” said Jain of AT Kearney.

BCG’s Rahul Jain said consulting has evolved from being knowledge-based to focusing on execution and results. “Now it’s about capability, helping clients not just design strategies but build and strengthen businesses. AI will increasingly be an integral part of this journey, embedded across future client assignments.”

You may also like

Ike Turner Jr dead: Tina Turner's son dies aged 67 after battling multiple health issues

Women's World Cup: Kranti And Deepti Pick Three Each As India Beat Pakistan By 88 Runs

I'm a motoring expert - used car buyers must check 1 thing to expose secret past

'Within 2 days': Mahagathbandhan set to announce seat-sharing formula; RJD says few issues yet to be sorted

Chaos in NATO country as airport closed for hours after 25 hot-air balloons enter airspace