Business-to-business ecommerce unicorn Udaan has flown into rough weather with its growth engine sputtering and revenues going flat.

Once hailed as the digital backbone of India’s fragmented wholesale market, connecting manufacturers, brands, traders, and small retailers across categories from FMCG and lifestyle to electronics and pharma counting on its strict fiscal discipline to wriggle out of the fiscal mess and green shoots of revival have started showing.

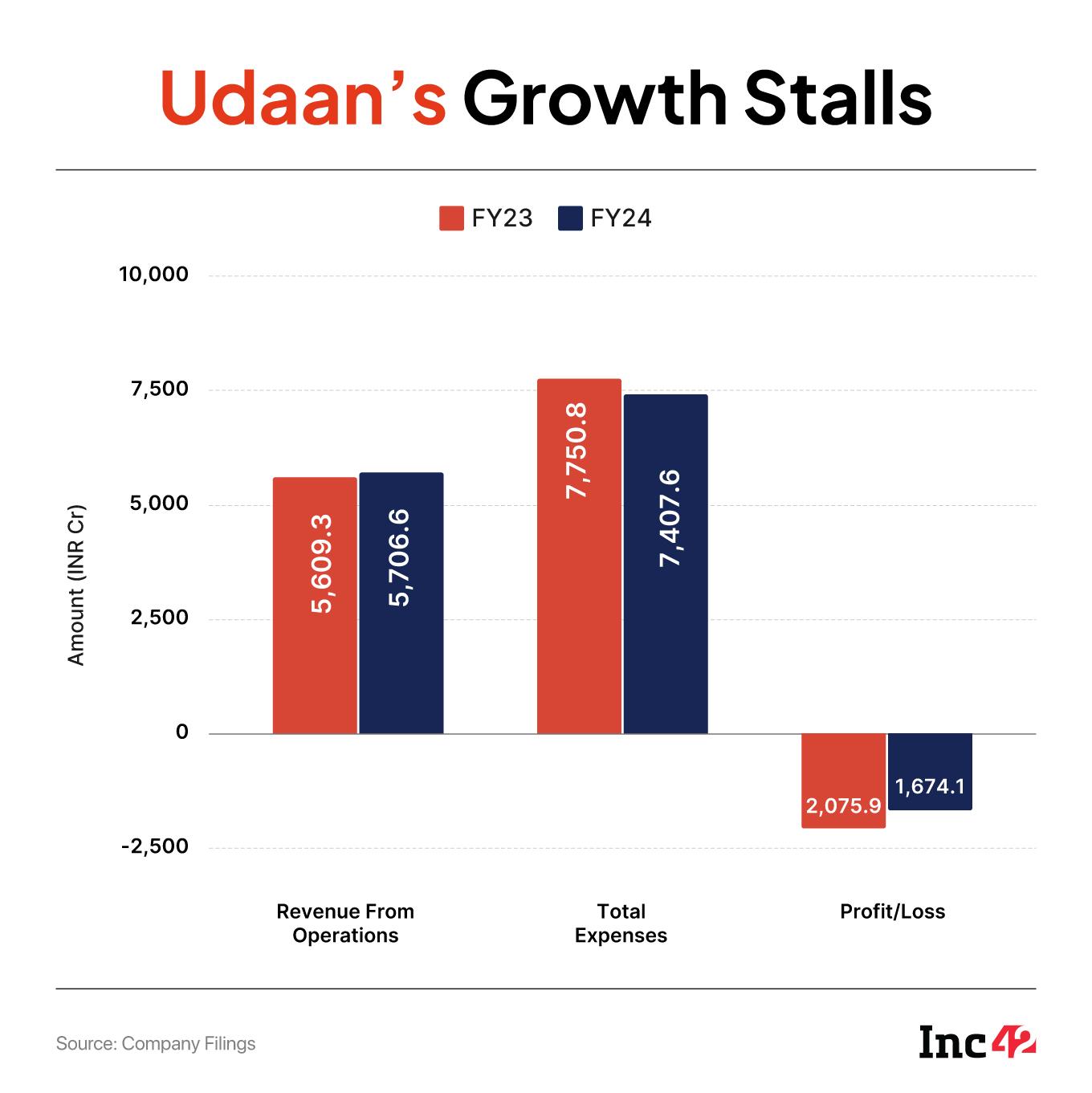

The company’s gross merchandise value (GMV) inched up barely 1.7% to INR 5,706.6 Cr in FY24 from INR 5,609.3 Cr a year before, staggering far below the INR 9,900 Cr peak it scaled in FY22, showed filings by its Singapore-based parent Trustroot Internet. Udaan’s consolidated revenues remained flat as it struggled to scale in a tight funding environment and evolving retail dynamics.

Inc42 awaits responses from Udaan to questions sent on its FY25 financials, market share, and other fiscal parameters.

Udaan’s crisis stemmed from a general downturn in India’s B2B ecommerce companies since the last two years. In the initial years, around 2010-11, these were restricted to pure-play technology, connecting retailers to wholesalers and brands through marketplaces, but later on expanded their operations to logistics and warehouses. This called for huge investments.

With profitability going bleak, a slowdown in funding hit the industry around 2023. As the funds flow dried up, Udaan’s valuation declined nearly 59% from its peak of $3.2 Bn to around $1.3 Bn in its latest Series G round. The $114 Mn round earlier this year brought some relief with some improvement in cash position, but underscored the market’s growing demand for disciplined, margin-focussed execution over blitzscaling.

Founded in 2016 by former Flipkart executives Sujeet Kumar, Amod Malviya, and Vaibhav Gupta, the Bengaluru startup has sought to reinvent itself as a three-layered ecosystem, rather than just a wholesale marketplace. Its logistics arm Udaan Express now powers the supply chain and delivery network, while fintech vertical UdaanCapital offers working capital and invoice financing to retailers. With the acquisition of ShopKirana, Udaan has deepened its presence in retail-tech and last-mile distribution.

These verticals are designed to build an integrated, defensible model that is expected to embed the company more deeply into the everyday operations of India’s small and medium retailers.

“What Udaan is trying to build already exists in a different form. India has a strong dealer and distributor network and most companies sell through dealers, franchisees, or local distributors. So when retailers need goods, they have someone to supply them, at least up to the district level. It’s not a deep network everywhere, but it does exist,” pointed out a former Udaan executive, requesting anonymity because he was no longer working with the company.

Udaan wanted to change this by enabling even the smallest kirana stores to order goods online and have them delivered directly. But, many FMCG companies and vendors didn’t want to work with Udaan because it disrupted their existing dealer network. Parle, for example, still doesn’t work with them as they were uncomfortable losing control over their supply chain, and their distributors didn’t want extra competition either.

Despite muted topline growth, Udaan’s fiscal discipline has started showing early signs of payoff – the FY24 losses are down over 19% through cost optimisation and restructuring. But as India’s B2B ecommerce landscape goes into a shake-up, the challenge for Udaan is clear – can this integrated, capital-heavy model finally deliver sustainable margins in a market where thin spreads and credit risks continue to crush even the most ambitious players?“The B2B category is a tough space – very thin margins and extremely tight unit economics. Efficiency has to be very high, but that hasn’t been their focus. Unless they completely rethink their approach and do something drastically different, I don’t see them doing very well. Their track record so far has been far from good,” said the former insider.

Multi-Stream Revenue Engine Revs UpUdaan has a diverse revenue stream. It earns from the sale of traded goods, platform and transaction fees, logistics services, credit facilitation, and advertising. The company also generates ancillary income from scrap sales of returned goods and collection services related to credit repayments, as well as processing fees on loan disbursals through UdaanCapital.

At the heart of Udaan’s business lies its marketplace, where retailers can discover suppliers, compare prices, place bulk orders, and secure delivery and financing through a single interface. Udaan offers customised product offerings for different regions, promotes price transparency, supports inventory management through order quantities as low as INR 3,000 and next-day doorstep delivery for over 90% of items.

The FY24 consolidated statements reflect both the scale and strain of this transformation. While the topline remained flat, losses narrowed 19% as the company tightened costs and optimised its workforce.

A multi-layered approach to Udaan’s revenue model captures value at several points in the B2B supply chain. The majority of its income comes from transaction and commission charged on trade between suppliers and retailers – its core marketplace function. In FY24, selling and distribution revenue contributed over 60% of the total operating income, according to the statements.

Advertising, logistics services, and technology usage fees, which together form the value-added services offered to merchants, make up a substantial chunk of the startup’s topline. The fintech arm, UdaanCapital, has emerged as a crucial growth engine, providing working capital and invoice financing to retailers and generating more than a fifth of total revenue through interest and processing charges. It also collects smaller but recurrent income from scrap sales of returned goods and collection fees related to credit repayments.

“What gives Udaan its edge is the depth and integration of this ecosystem. Its in-house logistics network, Udaan Express, enables faster and more reliable delivery across a large number of smaller cities, while its embedded fintech capabilities offer merchants easy access to credit at the point of purchase,” said the founder of a rival B2B ecommerce platform.

In a behemothic country like India, logistics has always been the steepest hurdle for the B2B ecommerce sector in covering both the people and the distance. With Udaan Express, the startup tries to turn the pain point into a profit lever. As a fully integrated logistics and supply chain arm, it powers the platform’s daily delivery operations across thousands of cities and towns, handling everything from warehouse management to last-mile fulfilment.

For a marketplace that deals with high-frequency orders in fast-moving categories like FMCG, lifestyle, and HoReCa, the control over logistics isn’t just an operational advantage – it’s a strategic necessity.

By keeping logistics in-house, Udaan reduces its dependence on third-party providers and gains greater control over delivery timelines, order accuracy, and cost. This integration allows for tighter coordination between demand forecasting, inventory flow, and credit cycles, enabling the company to synchronise supply with financing and purchasing behaviour. Udaan Express also improves working capital efficiency for retailers, who rely on timely deliveries to maintain stock turnover.

The model improves margins over time by eliminating external markups and providing data insights on route optimisation, cluster density, and order frequency. It also brings operational complexity and capital intensity. Running a national network in a market that’s growing to reach $200 Bn in the next five years requires continuous investment in fleet, warehousing, and technology, particularly as Udaan expands into high-density urban clusters and Tier II and III cities, where infrastructure remains inconsistent.

There’s a puzzle in this format. While dense cities can generate profitability faster, rural and semi-urban networks offer long-term defensibility and reach.

Fintech Integration Brings StickinessIn India’s B2B ecosystem, access to affordable working capital remains one of the biggest challenges for small and medium retailers. Traditional banks drag their feet on lending to kirana stores or small distributors because of limited credit history and inconsistent cash flows.

The founders positioned UdaanCapital in this structural gap to integrate credit directly into the buying process. The fintech venture gave merchants the leeway to order inventory on credit, repay in flexible tranches, and grow their businesses without external borrowing hassles. A boost to merchant retention was foretold.

As UdaanCapital aligned its short-term working capital loans, invoice financing, and credit lines with the merchants’ purchasing cycles, it gradually became a powerful monetisation engine, contributing a large chunk to its topline. Its embedded financing ensures that merchants transact more frequently and remain loyal to Udaan’s ecosystem, making it a vital retention lever in an intensely competitive B2B market.

Every transaction feeds into a larger dataset that helps Udaan refine its credit scoring, demand forecasting, and risk assessment. By using behavioural data, such as order frequency, repayment cycles, and product categories, Udaan can dynamically evaluate creditworthiness, a capability that traditional lenders lack. This feedback loop helps balance risk with opportunity, especially in a high-risk SME segment where defaults can quickly erode margins.

Lending in the SME space, however, demands a strong collections infrastructure, rigorous KYC and compliance mechanisms, and robust risk management frameworks. Udaan must also navigate regulatory oversight as the Reserve Bank of India tightens norms around digital lending and NBFC partnerships. Ensuring credit discipline while maintaining ease of access will be key to scaling sustainably.

By owning both the commerce and credit relationships, Udaan gains deeper insight into merchant behaviour and a stronger hold over its ecosystem, converting financial enablement into a long-term competitive moat that few rivals can replicate.

The acquisition of ShopKirana marked a pivotal moment in Udaan’s evolution from a pure-play marketplace to a retail-tech ecosystem. ShopKirana, which had built a strong presence in FMCG distribution and HoReCa (hotels, restaurants, and cafes), brought with it a network of local retailers and a technology stack focused on retailer efficiency.

The strategic intent behind the acquisition of ShopKirana goes beyond scale. It represents Udaan’s effort to deepen merchant engagement through tech-driven retail solutions, including inventory management, predictive ordering, and analytics-based recommendations. These tools empower small retailers to manage stock, forecast demand, and optimise assortment with data-backed precision that holistically improve turnover and reduce wastage. For Udaan, this translates into higher order frequency, better predictability in demand cycles, and improved platform utilisation.

ShopKirana’s operational model complements Udaan’s logistics and fintech arms. By digitising retailer operations, Udaan gains access to granular data on sales velocity and purchasing behaviour that feed directly into its broader profitability strategy.

The acquisition further reinforced Udaan’s presence in the FMCG and HoReCa segments, which remain the most defensible and high-frequency categories in B2B commerce. These verticals ensure steady order volumes even during economic slowdowns and offer opportunities for cross-selling financial and logistics services. For retailers, the value proposition is clear – lower inventory risk, better access to brands, and a smoother procurement experience powered by digital intelligence.

The ShopKirana deal signals Udaan’s transition from being a transactional intermediary to becoming an end-to-end enabler of India’s retail economy. By combining marketplace reach, logistics execution, fintech integration, and retail-tech capabilities, Udaan aims to create a self-reinforcing ecosystem that drives repeat demand and operational efficiency. In a market where margins are thin and loyalty is fleeting, ShopKirana’s integration gives Udaan the tools to move towards sustainable profitability.

Blips Of Profitability Turns LouderAs one of the early movers, Udaan has stood witness to the rapidly evolving dynamics in India’s business-to-business ecommerce landscape that’s set to unleash a $4,709 Bn opportunity, averaging a 21.6% annual growth till 2030.

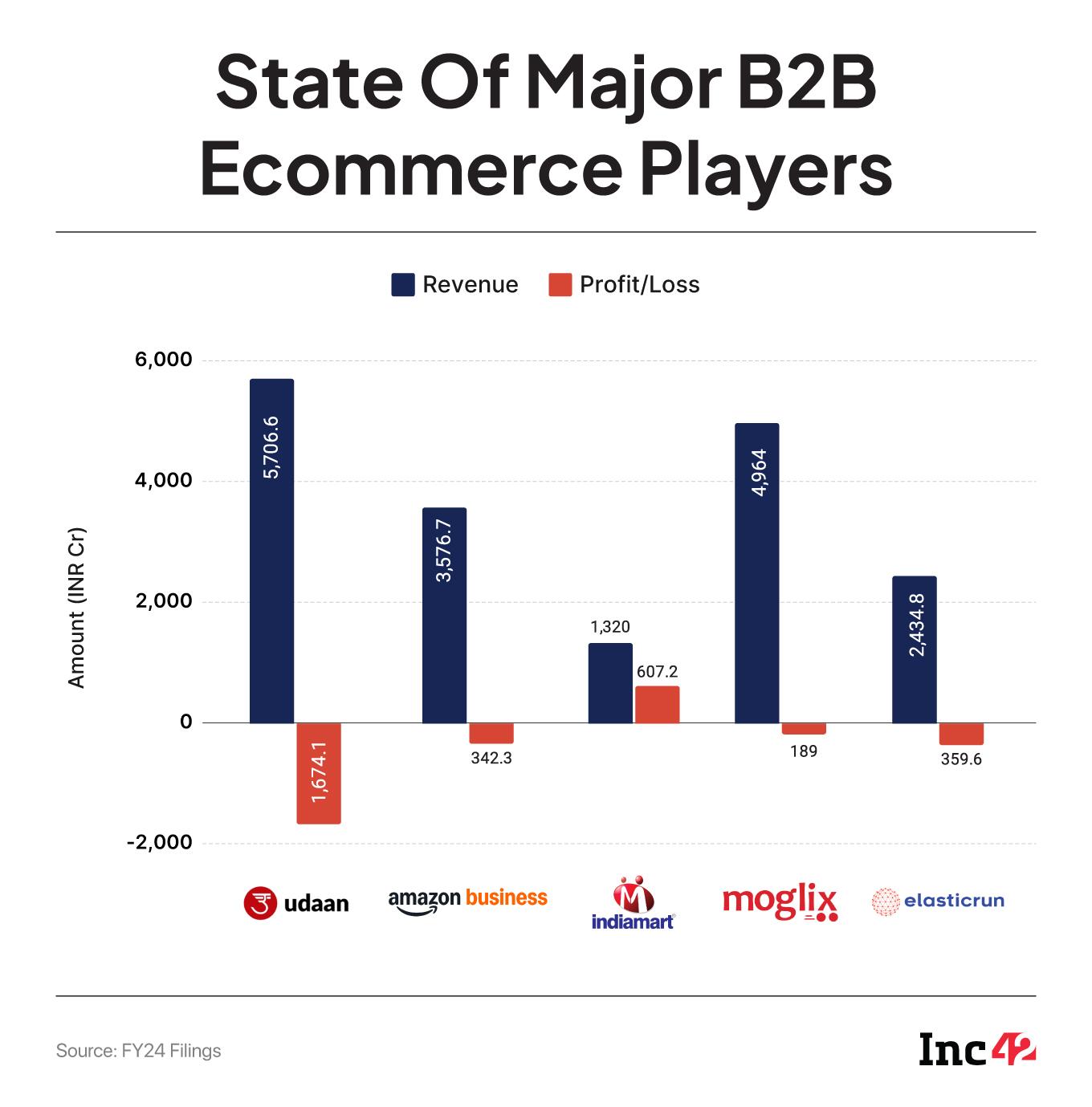

On this simmering turf, Udaan faces competition from ElasticRun that is focussed on rural markets, local brands, and innovative supply chain solutions like single-city dark stores, enabling faster deliveries and better margins. This contrasts with Udaan’s broader, urban-focused B2B model.

“Since I’ve seen Udaan’s business up close, I’d say their main issue is lack of focus. They’ve tried to do too many things at once. Their business was largely centred around FMCG clients, but at different times they’ve also worked with apples, electronics, and other categories, instead of focusing on one area. In fact, they’re not known for focus, they’re known for doing a lot of things all at once,” said the former Udaan executive.

This ‘big commerce’ approach, while showing versatility, has led to operational complexity, thin margins, and inefficiencies in execution.

The second big issue was pricing. To attract kirana store owners and make them switch from their usual suppliers, Udaan had to offer better prices. This meant deep discounts, which cost them heavily. “I think they’re now focussing on specific segments, cutting back on discounts and jacking up the volumes,” he said.

Profitability may still appear foggy, but there’re loud blips of revival on Udaan’s radar. “Our daily buyers have grown 60% and monthly buyers 30% over the last 12–18 months. On cost, we redesigned our supply chain, reducing costs from 10% to 3.5%. We slashed fixed costs by 90% by rethinking our organisation structure,” asserted CEO Vaibhav Gupta in a recent media interview.

[Edited by Kumar Chatterjee]

The post How High Can Udaan Fly? A Look Into Its Blueprint For Revival appeared first on Inc42 Media.

You may also like

'American patriot of the highest quality': Trump awards Presidential Medal of Freedom posthumously to Charlie Kirk- watch

Strictly's Dianne Buswell and Stefan Dennis issue BBC update after health absence

Fox News breaking alert as Donald Trump erupts at 'ABC fake news' reporter

Fury over taxpayer money use as illegal migrants get free art classes and English lessons

Labour minister makes huge admission on Channel migrant crisis and lack of control